Resources

Search below for resources covering the intersection of climate engagement, social science and data analytics.

RESULTS

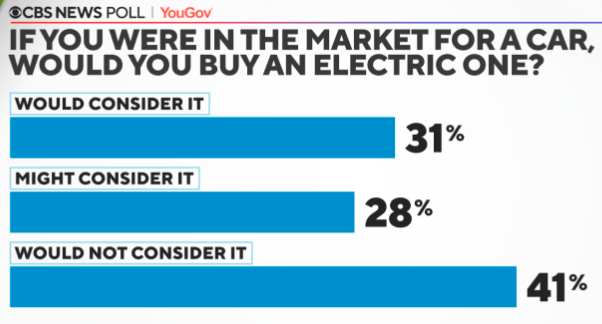

Poll: Higher gas prices a factor for those considering a hybrid or electric car

For Americans who would consider purchasing an electric vehicle, high gas prices are now nearly as common of a rationale as environmental reasons. 31% of adults say they would consider purchasing an electric vehicle if they were in the market for a car today, compared to 30% who said they would consider an electric vehicle when asked the same question last April. Notably, when the poll asked interested consumers why they would consider a hybrid or electric vehicle, high gas prices (63%) only narrowly trail environmental cleanliness (66%) as a rationale for those interested in buying hybrids or EVs. These factors were cited far more often than the next most common rationales, including the fact that car companies are shifting to making more hybrids and electric vehicles (44%) and the increase in models and options to choose from now (42%).

Few have heard about the Biden administration’s decision to allow higher-ethanol gasoline blends, but voters learn toward supporting the decision as a way to reduce gas prices. The latest national tracking poll from POLITICO and Morning Consult finds that just 15% of voters have heard “a lot” about the U.S. government allowing summertime sales of higher-ethanol gasoline blends in order to reduce gas prices. When informed about the decision with the following explainer, however, voters support the move by a 42%-28% margin (with 26% unable to give an opinion): “As you may know, President Biden announced that the government would allow summertime sales of higher-ethanol gasoline blends in order to reduce gas prices. While this could lower gas prices, some say that higher-ethanol gasoline blends can contribute to smog in warmer weather. Do you support or oppose allowing summertime sales of higher-ethanol gasoline blends?”

Most Americans say they “support a ban on Russian oil” even if it means higher gas prices. 71% claim that they would “support a ban on Russian oil, if it meant higher gasoline prices in the United States.” The ban has strong majority support across the political spectrum with 82% of Democrats, 70% of independents, and 66% of Republicans in favor of it.

Electric School Bus Initiative

World Resource Institute’s Electric School Bus Initiative aims to build unstoppable momentum toward an equitable transition of the entire U.S. school bus fleet to electric by 2030, bringing health, climate and economic benefits to children and families across the country and normalizing electric mobility for an entire generation. Together with partners, WRI is working in six areas of focus, whereby they: support school districts in accelerating the equitable transition to electric school buses; collaborate with manufacturers across the electric school bus supply chain in preparing for an equitable and sustainable transition; work with electric utilities to improve interconnection and investments for electric school bus charging infrastructure, including supportive rates and tariffs; facilitate understanding of electric school bus business models and promote the expansion of funding and finance options in the electric school bus market; engage policymakers at the federal, state and municipal levels to reduce barriers to equitable school bus electrification; center communities in pursuing school bus electrification and work with community-focused organizations to help provide the tools and resources to make it happen.

People’s Justice40+ Community Benefit Plan Playbook: A Guide to Capturing Federal Infrastructure Investments

Federal infrastructure and climate investments have the chance to significantly benefit the communities that need them most. This playbook offers frontline groups and community organizations guidance for developing plans to harness the infrastructure investments of major federal initiatives – such as the 2021 Infrastructure Investment and Jobs Act – to meet community needs. This playbook will answer a range of questions about the different federal spending bills, including: What are the various bills? How much money is available? What kind of money is it – grants, loans, contracts? What are the restrictions? What can the money be used for? How will the money flow from the federal government to state and local governments? Who is eligible to get the money? What are the potential community benefits? How can you influence how the money is spent? How can you organize your own community benefit strategy and plan? Where can you get more information and technical support?

Electric Vehicle Outlook 2022

Electric vehicle (EV) sales are surging due to policy support, improvements in battery technology, more charging infrastructure and new compelling models from automakers. Electrification is also spreading to new segments of road transport, setting the stage for huge changes ahead. China still dominates the global EV market, but sales are rising quickly elsewhere too. Battery electrics are pulling ahead of plug-in hybrids and the gap is set to widen further in the years ahead. More and more charging points are being built, but each country will have its own optimal mix of home, workplace and public chargers. EVs of all types are already displacing 1.5 million barrels per day of oil usage, equivalent to about 3% of total road fuel demand.

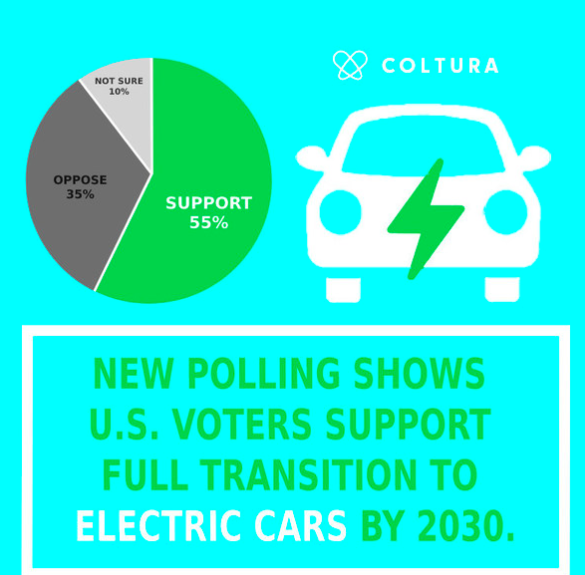

New Polling Shows U.S. Voters Support Full Transition to Electric Cars by 2030

Most voters support requiring all new cars sold in their state to be electric starting in 2030. Tax rebates and new charging infrastructure are key drivers of interest in purchasing electric vehicles. Registered voters feel positively about electric vehicles by a wide margin (65% positive / 24% negative) and, importantly, voters generally believe that electric vehicles “save consumers money on fuel because electricity is cheaper than gas” (56% agree / 15% disagree). Other positive beliefs that most voters have about electric vehicles are that they are better for the environment than gas-powered vehicles (70% agree / 11% disagree) and as safe as gas-powered cars (55% agree / 12% disagree). Still, among consumers who plan to purchase or lease another vehicle in the next five years, only about half (49%) say they’re likely to purchase an electric vehicle. Vehicle costs and convenience concerns emerge as clear barriers for most people in thinking about electric vehicles: nearly three-quarters of voters (73%) agree that electric vehicles are more expensive than gas-powered cars and about half (51%) agree that electric vehicles don’t have the range to cover the average American’s daily driving needs. Clear majorities of voters nationwide say they would be more likely to consider an electric vehicle if there were more electric vehicle charging stations in their local area (65%) or if they were provided a $7,500 federal tax rebate for an electric vehicle purchase (63%).

Poll: Voters Strongly Back Climate-related Infrastructure Investments

Survey data from 19 competitive House districts across the US revealed strong support (59%), across party lines, for the American Jobs Plan. Notably, the provisions that would address the climate crisis garnered even stronger support than the overall infrastructure plan did.

Among the specific provisions designed to address the climate crisis:

- 82% of voters support investments to rebuild roads and bridges and modernize public transportation to ensure it is cleaner and able to serve more people.

- 81% of voters support overhauling our country’s drinking water infrastructure.

- 70% of voters support addressing the challenge of climate change by shifting to greater use of clean energy, reducing carbon pollution from vehicles and industry, and making homes and buildings more energy efficient.

- 69% of voters support investments in clean energy such as wind and solar power by extending tax credits to spur innovation and manufacturing.

- 61% of voters support investments in electric vehicles and charging stations to reduce pollution and help more Americans buy clean cars.

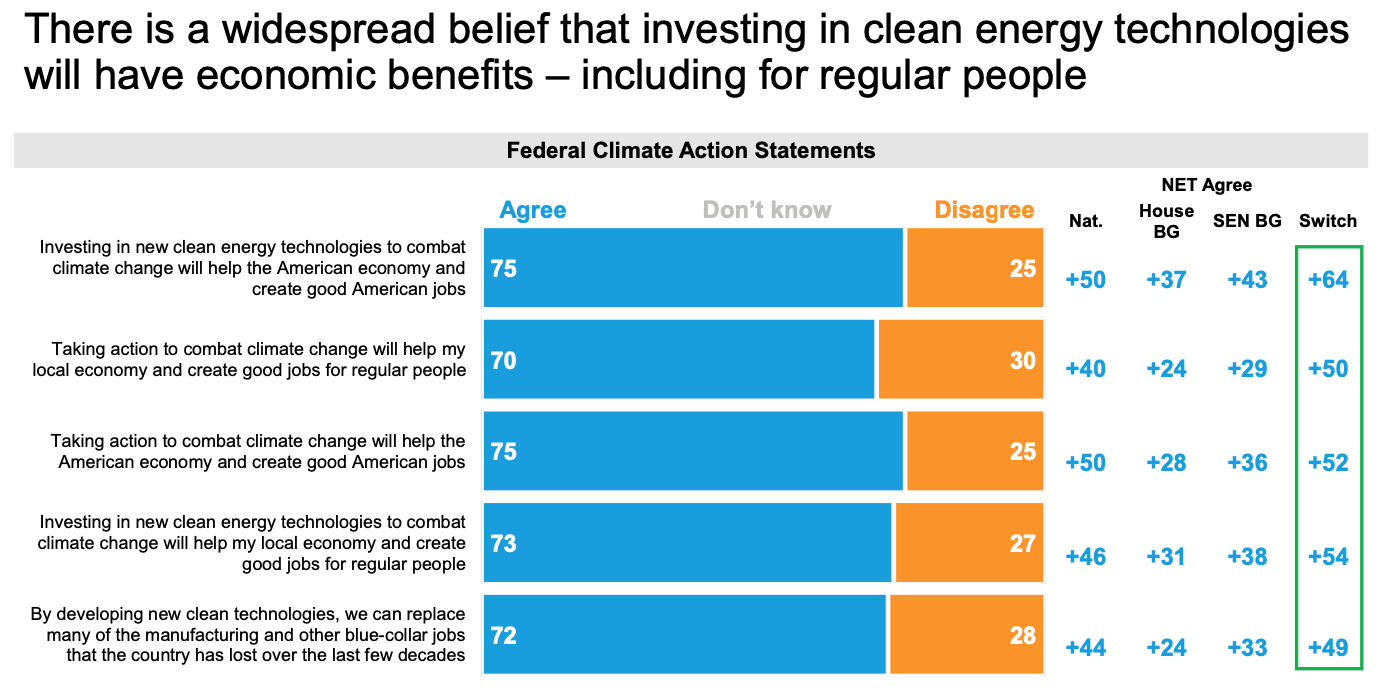

Poll: Investing in American Clean Energy to Build the Industries of the Future

Key findings of a survey (phone and online) of US voters, with oversamples in key states include:

- Voters across the political spectrum overwhelmingly support government investments in clean energy technologies in order to rebuild the economy (77%), create good jobs (76%), and eliminate the carbon emissions that cause climate change (75%).

- There's a widespread belief (75%) that investing in clean energy technologies will have economic benefits – including for "regular people."

- And also that by developing new clean technologies, we can replace many of the manufacturing and other blue-collar jobs that the country has lost over the last few decades (72%)

- Strong support for various approaches to boost and develop specific clean energy technologies such as clean steel and cement, clean jet fuels, and energy storage and transmission.

- Voters support investing $75 billion in clean energy tech RD&D as part of the upcoming infrastructure bill.

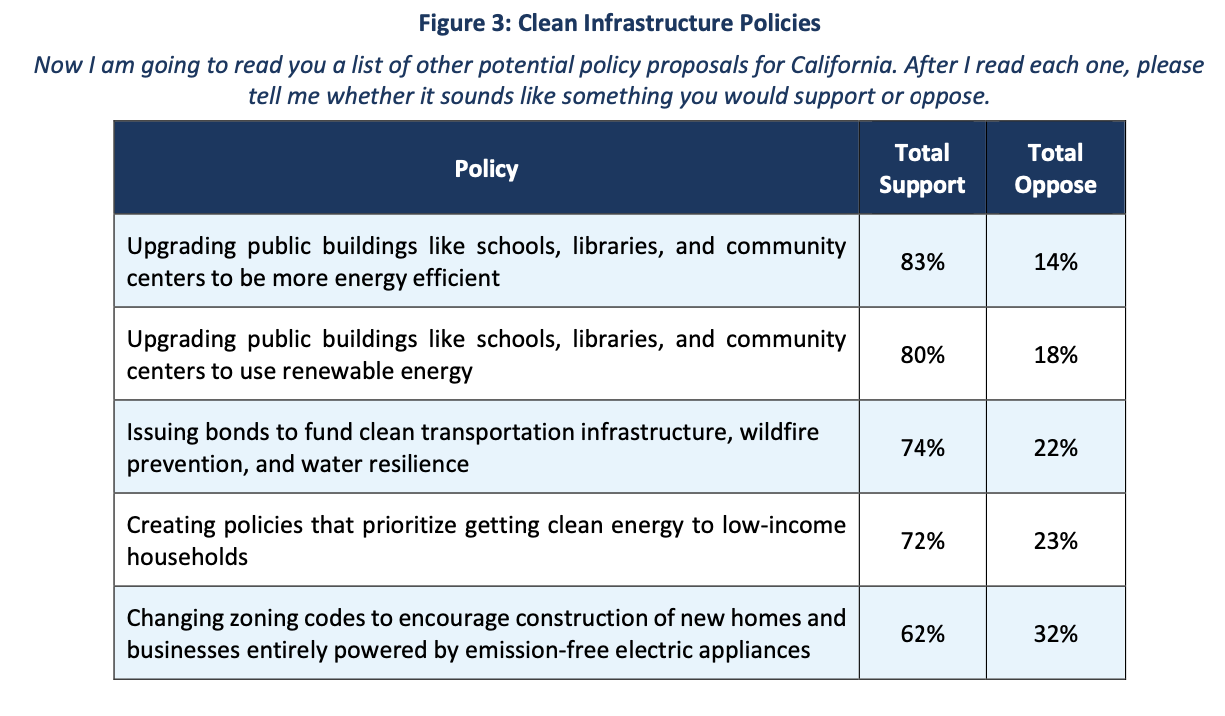

Survey of California voters’ views on climate change, renewable energy, infrastructure, and transportation found that a majority of Californians believe the state should act more quickly to address climate change, see economic promise in renewable energy; and support a range of policies to move away from fossil fuels.

- 67% believe that the State should act quicker to address climate change.

- 75% believe climate change is an "extremely," "very," or "somewhat serious" problem facing California and 38% categorize it an “extremely serious problem”.

- A majority of Californians support a range of policies to move away from fossil fuels, including providing energy upgrades to schools, libraries, and community centers; funding clean transit infrastructure, wildlife protection, and water resilience through the issuing of bonds; and policies which bring clean energy to homes.

- A solid majority of Californians also support a variety of zero-emission transportation policies, including ones that would cut pollution near ports and warehouses and transition the state to a zero-emissions truck and bus fleet within the next 15 years.

- By an 11-point margin, voters see more harms from fossil fuel infrastructure than benefits and half of California voters (50%) say that they would be less likely to vote for their state legislator if that official took campaign funds from fossil fuel companies.

Pagination

- Previous page

- Page 3

- Next page